Mutual Funds

AMFI Registered Mutual Fund Distributor

ARN Number: 271316

Mutual Funds

Invest Smart :

Discover Mutual Funds!

Get expert advice and financial services tailored to meet your financial goals. Elaborate Capital ensures you safer and consistent returns to lead a better present and brighter future.

Build Wealth Starting with Starting with Just Rs. 500!

Mutual funds are a powerful way to grow wealth and achieve financial goals. Whether you are a beginner or a pro-investor, Elaborate Capital will provide expertise, resources, and a platform to invest in mutual funds. So, build a strong investment portfolio.

Start your mutual fund investment

journey with just Rs. 500 with Elaborate Capital.

Start your mutual fund investment journey with just Rs. 500 with Elaborate Capital.

Hit Your Financial Goals with SIPs!

- Start with just Rs.500

- Build financial discipline

- Beat market inflation

- Get Returns you can never imagine!

Why Elaborate Capital

Why Choose Elaborate Capital For Your Mutual Fund Investment?

Gain access to a list of best-performing mutual funds from top Asset Management Companies (AMCs) in different categories, such as equity, debt, hybrid, and others.

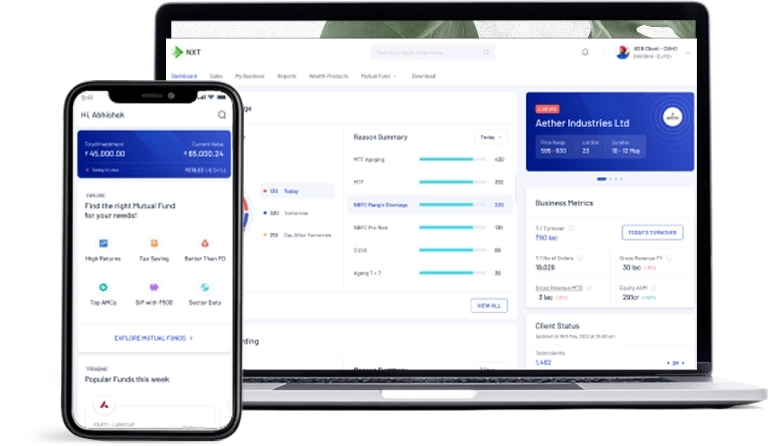

Our user-friendly platform will provide an easy way to search, compare, and invest in mutual funds with simple clicks.

Get detailed research reports, fund analysis, and expert opinions to help you make wise investment decisions.

Get a seamless and smooth investment experience with safe and convenient online transactions.

Stay updated on market trends and fund performance with our periodic market updates and newsletters.

Track your performance in real time and make changes accordingly.